The Case for Coal Retirement Pilots: Insights from Asset Owners and Investors

May 2, 2022

Matt Carpio, Head of Transaction Advisory

Lawrence Ang, Managing Partner

Source: Bloomberg/Getty Images

Since COP26, interest in coal retirement has grown tremendously with various reports, feasibility studies, and commentary now under circulation. The latest IPCC report makes it clear that this decade is the “now or never” timeline to establish a resilient future that safeguards the 1.5 Centigrade temperature threshold set by the Paris Agreement.

While there is no argument that shutting down coal plants is an essential piece in the decarbonization and resilience-building toolbox to meet Paris goals, there is less agreement on the “who”, “when” and “how” of implementing coal retirement programs, specifically in developing country and Global South contexts. And despite its potential to meaningfully steer transition efforts across power-hungry markets away from further emissions growth and carbon lock-in, with the exception of a few initiatives, real-world transactions in the space have not been pursued as aggressively, largely owing to a lack of consensus and typology of what constitutes legitimate “transition investments” or just greenwashing.

Climate Smart Ventures (CSV) has been proactively engaging a variety of stakeholders from the private sector, public sector (including governments and multilateral institutions), civil society, and philanthropies active in Southeast Asia to participate in a platform originating from the Global South: the Asia Energy Transition Platform (AETP). The AETP aims to mobilize private capital to accelerate coal retirement and green replacement transactions. And what we’ve learned is that there is no one-size-fits-all approach to enabling the “just and managed transition” of coal-fired power plants (CFPPs). What is clear, however, is that this is perhaps one of the few genuine instances in climate change mitigation where real-world pilots anchored to developing-country circumstances can really make a difference in contributing to the 1.5 Centigrade limit of the Paris Agreement and resilience-building, especially for coal importing countries. To explain further, here’s a snapshot of our findings to date:

1. The Perfect is the enemy of the Good

We need to adopt and enable a learning-by-doing approach that calls for increased collaboration across stakeholders for the enhanced deployment of targeted coal retirement pilots.

Successfully piloting a coal retirement transaction today to model out technical, financial, and social parameters that can demonstrate real value creation will drastically change the landscape while contributing to a “learning-by-doing dividend” for meaningful improvements in policy and energy transition mechanisms.

Thankfully, the ingredients to mobilize a pilot transaction are already in place – many governments, asset owners, and financial institutions are considering Coal Transition Mechanisms (CTMs) either on their own or with others. Where the largest doubt resides is interestingly not so much the “additionality” or the true impact of such CTMs on climate, but rather on acceptable structures that can allow investors to stay consistent with their coal divestment policies. And this is why perhaps several potential participants are adopting a “wait and see” approach, looking towards the first few deals to de-risk and set the tone for participation in future transactions as the possible exception to their policies or the impetus for creating completely new ones (e.g., “transition investments”).

This therefore clearly establishes the importance of what multilateral actors such as the Asian Development Bank (ADB), Climate Investment Funds (CIF), and others are trying to achieve with the Energy Transition Mechanism (ETM). However, while the ETM is trying to encourage government-driven phase-out packages at the fleet level (macro-scale), CSV is strongly advocating for private sector-led CTMs at the asset level (micro-scale) as an urgent and practical complement. This is because the private sector, thanks to its agility and interest to align with the Paris Agreement, can be relied upon to maximize existing market-based mechanisms and structures to achieve the same goal of coal phase-out if packaging the programmed retirement of CFPPs as well as justly transitioning grids, workers and communities to renewable energy (RE) yield a net positive value proposition.

There is already growing pressure from investors, affected communities, and the public-at-large to establish ample safeguards against the moral hazards of the private sector “investing in coal to end coal”. There is also growing literature and frameworks for managing the grid security implications of coal transition and price transparency that altogether make a compelling case for designing context-appropriate and market-specific coal retirement transactions as opposed to “one-size-fits-all” approaches that may be detrimental to market sustainability and/or grid security. And such cold-eyed appraisals and perspectives are particularly important for countries that do not have strong coal phase-out policies as designing the right incentives to make the “shared pain” of phasing out a coal plant way ahead of its end of technical life will be key to scaling CTMs beyond pilots.

So, while indeed coal retirement as a concept is fast gaining momentum, mobilizing, learning from, and completing pilots can have far more formidable effects in catalyzing much-needed resources towards CTMs that can actually help public and private players achieve net-zero targets.

2. Shared Pain for Collective Gain

The primary goal of any CTM is to shut down CFPPs for good as soon as possible. This cannot, however, be haphazardly done without considering the technical and social realities of the plant, as previously mentioned, but more so the economics of the plant.

Accelerating the shutdown of a CFPP post-acquisition can be financially managed in two ways: lowering the acquisition price and lowering the required returns post-acquisition.

Based on ongoing dialogues and modelling with asset owners and investors, baking both lowered acquisition costs and required returns into any coal retirement and green replacement transaction drastically shortens the timeline for retirement to a post-acquisition life of 9 to 14 years – enough runway to prepare for a just and managed transition (and let’s not forget, the actual work of plant decommissioning).

In managing the acquisition cost, asset prices need to be refreshed. Several geopolitical and regulatory variables have changed over the last 3 to 5 years including increasing volatility of commodities, particularly the price of coal and oil, affecting CFPP operations in the long-term. Investors and power players are not keen on re-investing in brownfield or greenfield CFPPs based on existing business models given coal divestment or net-zero policies, further narrowing the market for these assets. Additionally, both asset owners and investors are having to manage the perception and moral hazard issue of “rewarding” polluters while seeking an acceptable return (assuming the absence of external regulatory and legal pressures).

These constraints, among others, are justifying a further reduction from the market average of $1.7-$1.8 million per megawatt in CFPP acquisition prices based on previous transactions in Asia. This is not to say that asset owners will not try to push for a fair value for their assets, but it’s safe to say that they also see the writings on the wall that the price per MW is dropping due to issues in the future of coal, making conversations around retirement today more relevant than ever.

In managing required returns, they have to be decreased to lessen the pressure on the CFPP to operate at normal levels so as to recoup the investment and hit return targets. To make this interesting to a wider spread of public and private investors, this cannot be a zero-return investment, but it can’t be the usual 10% to 12% annual return either. Investors have to accept lower returns to further help the plant minimize its post-acquisition run life and, in turn, allow for its accelerated shutdown.

Put together, the shared pain of lowering acquisition prices for asset owners and lowering required returns for investors can result in the collective gain of achieving substantive cuts in emissions compared to the business-as-usual of CFPPs running up to as long as 40 to 50 years, with the ADDED benefit of still completing a genuine commercial transaction that many in this space believe is impossible. CSV is here to say, it is possible and it must be delivered early in this decade.

3. Building Something New Without Reinventing the Wheel

Coal retirement frameworks are and will be in constant development. CSV is of a view that a pilot transaction that concretely brings the technical, social and financial aspects of CTMs to life has the potential to spur more breakthroughs, and hence real impact, in this space.

Similar to other infrastructure projects, CSV recognizes that there are acceptable mechanisms and structures already in use that are highly suitable for coal retirement. These include traditional debt (e.g., senior/ mezzanine loans, sustainability linked bonds) and equity (e.g., preferred, common shares) and terms that can robustly enable coal retirement and energy transition such as specific KPIs or covenants tied to CFPP decommissioning, the re-investment of proceeds to RE (with storage if necessary), and other just transition principles. More efficiencies can also be realized if products that are already acceptable to both asset owners and investors, such as sustainable loans, green bonds, or “transition bonds” are specifically tailored for coal retirement alongside standardized documentation and taxonomies that recognize the legitimacy of such products in accelerating climate change mitigation efforts within this decade.

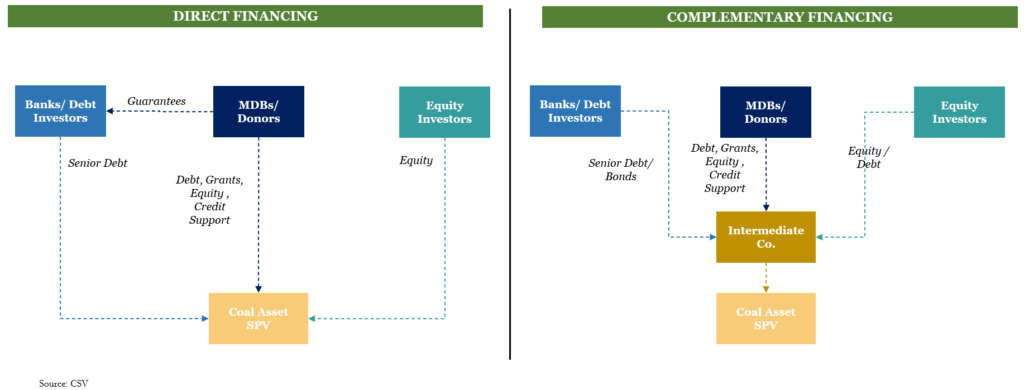

In terms of financial and legal structures, we’ve found that investors are open to two generic formats—direct and complementary investing into the CFPP for retirement.

While direct financing into the CFPP is straightforward enough, the prevalence of “coal divestment” policies for a number of investors (i.e., not being able to directly own coal assets) has made complementary financing approaches an interesting point of departure for further discussions as these highly mimic corporate finance loans or corporate bond structures already widely available in today’s market where covenants can be introduced to ensure compliance to key business parameters (e.g., use of proceeds, material change of business).

Furthermore, they provide potential leg room for investors to make the case for participating via equity in what CSV is calling “stewardship” SPVs which have as its mandate overseeing the transition of a CFPP in a just and managed manner—without necessarily owning the CFPP itself.

In closing, CSV recognizes that a blend of existing structures such as buy-outs, private and public debt and equity financing combined with worker and community support and development already provide a clear template for coal retirement transactions. And while indeed these structures can be further bolstered with frameworks fine-tuned to deliver more climate impact and social good, nothing could be more powerful in moving the needle today before COP27 than concretizing these concepts into cohesive pilots that demonstrate value creation and facilitate learning dividends towards consigning coal power to history to keep the 1.5 Centigrade limit within reach.

For more information, kindly email contact@climatesmartventures.com