Accelerated Retirement of China's Overseas Coal-Fired Power Plants Can Unlock Massive Energy Transition Potentials for South & Southeast Asia

December 6, 2022

Lily Gonzales, Associate

Lawrence Ang, Managing Partner

Christoph Nedopil, Director (GFDC)

Sarah Tang, Research Fellow (GFDC)

Photo by Pixabay on Pexels

What COP27 means for China’s transition from coal-based power generation in Asia

A foundational pillar of addressing climate change that was unthinkable only three years ago is now becoming reality: the early retirement of coal-fired power plants in emerging economies. During the G20, Indonesia launched its Just Energy Transition Partnership (JETP) – a breakthrough climate finance partnership designed to mobilize $20 billion in public and private financing over the next 3-5 years in support of Indonesia’s accelerated and equitable energy transition. Under the new partnership, Indonesia, one of the world’s most coal-dependent developing countries, has committed to reach an emission peak in its power sector by 2030, and systematically retire its coal fleet over the next three decades. At the same time, the Asian Development Bank (ADB) and Indonesia signed a Memorandum of Understanding to explore the early retirement of Cirebon-1, a 660-megawatt coal-fired power plant (CFPP) owned by CEP in West Java, which would mark the first deal to be developed under ADB’s Energy Transition Mechanism (ETM).

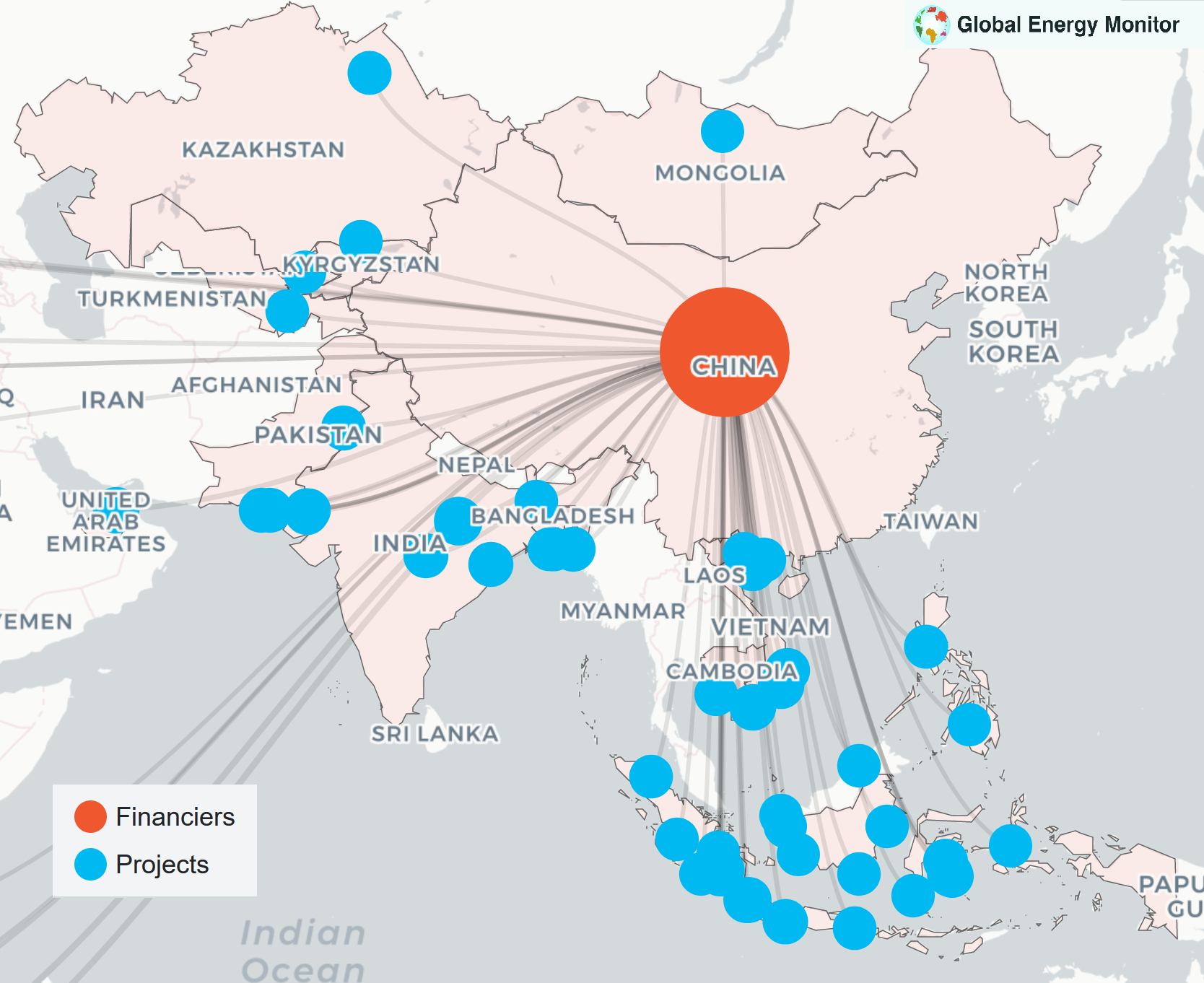

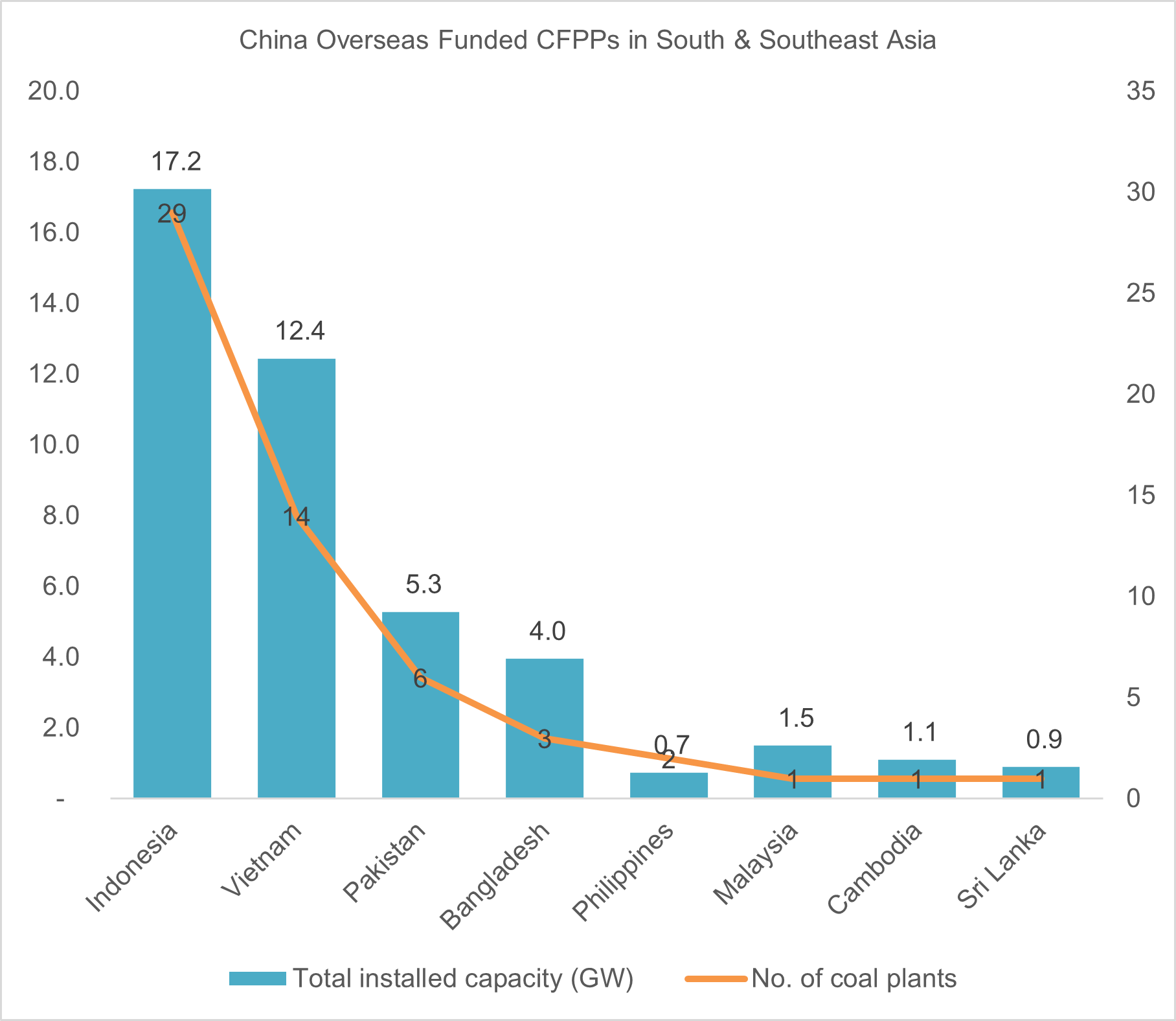

Such landmark initiatives can serve as a role model to further speed up coal retirement in the region, and can provide lessons for operators, investors and owners of coal-fired power plants. A particularly important stakeholder with a potential to accelerate the coal retirement in emerging economies is China: China is a major financier and investor in overseas CFPPs and currently supports 57 operating CFPPs (43 GW) in South & Southeast Asia with a combined total investment of US $25.5 billion (Global Energy Monitor).

China’s Overseas Funded CFPPs in South and Southeast Asia (Source: Global Energy Monitor)

After China pledged to stop building new coal plants abroad and to support the scale-up of clean energy at the United Nations General Assembly in 2021 and its commitment to fight climate change, the question is whether China can also support accelerated coal phase-out in the region.

Pathways for accelerating China’s international transition from coal-based power generation

Working with China to support the coal transition of the region as a means of strengthening the resilience of its regional partnerships should be a major policy priority for Asia’s net zero journey. Efforts currently being undertaken by multilaterals, national governments, and the private sector to phase out coal, including the recently launched Coal Asset Transition Accelerator (CATA), provide impetus for broader action on coal retirement also for China’s overseas fleet. For an overview of relevant mechanisms and approaches, a number of key references are available, such as a policy brief by GFDC, an article by Climate Smart Ventures, and a CBI-CPI-RMI report, to name a few.

At the same time, China’s unique structure of its overseas coal investments based mostly on Chinese state-owned enterprises (SOEs) and state-owned financial institutions (e.g., China Development Bank, ICBC) present an opportunity to create unique CFPP phase-out structure: As these parties are affiliated and owned by the Chinese government, SOEs can leverage inherent flexibilities that can significantly help CFPP operators and investors to consider accelerated timelines for retirement. The table below gathers several suggestions by experts to accelerate early retirement maximizing said SOE features:

|

Suggestion |

Description |

|

Deferred payments1 |

Debt service is adjusted to reduce cash generation pressure to SOE lenders and provide positive return to owners despite early CFPP retirement. |

|

Debt-for-climate swap1 |

Future payments owed to SOEs from operating CFPPs is relinquished in exchange for reduced emissions from early retirement of the CFPP. |

|

Discount on future payments1 |

The Chinese government can support its climate targets by imposing a discount on future payments to SOEs to financially disincentivize coal generation.

|

|

Shadow carbon pricing2

|

SOEs can create a stronger case to go green by incorporating the environmental costs into the analysis of its CFPP investments, addressing both the economic goals of the government with its own corporate goals. |

|

Ratepayer-backed securitization3 |

New capital is raised by issuing low-interest long-term bonds secured by ratepayers, and proceeds can be used to settle existing debt, accelerate the retirement of the CFPP, and fund a just transition. |

|

Asset portfolio securitization3 |

CFPP owner issues bonds securitized by revenues from a new renewable energy (RE) power purchase agreement to allow for early CFPP retirement and RE development. |

|

Transition Facilities or Mechanisms |

Financing and potential buy-outs in exchange for early CFPP retirement which can also require additional commitments (e.g. investments into renewable energy, grid upgrades, financing over-all transition of other affected stakeholders) |

1 Benoit, Philippe. “How China Can Retire Coal Early in Pakistan and Elsewhere Through the BRI.” Inter Press Service, 26 Oct. 2022, www.ipsnews.net/2022/10/china-can-retire-coal-early-pakistan-elsewhere-bri.

2 Benoit, Philippe, and John Luin. “ESG in Action: China’s State-Owned Enterprises Hold Keys to Carbon Neutrality.” Alliance Bernstein, 14 Sept. 2022, www.alliancebernstein.com/corporate/en/insights/esg-in-action/esg-in-action-chinas-state-owned-enterprises-hold-keys-to-carbon-neutrality.html..

3 D’Alelio, Drew. “Explainer: How Can Securitization Retire Coal Plants?” Clean Energy Finance Forum, 17 Jan. 2022, cleanenergyfinanceforum.com/2022/01/17/explainer-how-can-securitization-retire-coal-plants.

China can immediately evaluate a number of these key approaches to secure its position as a rising influence on global climate governance and finance. Important aspects to be considered to engage China in early retirement of coal fired power plants include:

- Assessment of the current value of coal fired power plants based on an in-depth evaluation of business models, contracts (e.g., power purchasing agreements “PPA”, financial agreements), financing conditions

- Assessment of political economy of decision makers and political risks in both the host country and in China, including an understanding of the political economy of possible stakeholders interested in an accelerated expansion of renewable energy

- Financing models for early retirement and transition that can support buy-down or buy-out of coal-plants under the specific circumstances

- Cost, business models and scale for alternative electricity installations (e.g., solar, wind) to ensure stable electricity supply

- Just transition considerations to provide jobs and compensation for affected workers

Cementing its role as a leader in accelerated GHG reduction via early CFPP retirement

Many good ideas contribute to the growing conversations around early CFPP retirement, but the key to success is to engage China and the host countries from financial, social, and political-economic perspectives. Only through creating a positive business case for Chinese SOEs, guaranteeing energy security and solvency for the host countries, and ensuring a just transition for affected workforce, will an early CFPP retirement become viable and palatable to stakeholders. Much of this depends on China’s political will and its capacity to evaluate and negotiate options that might lead to lower electricity costs and CO2 emissions for the host countries. Built upon the momentum through JETP and other international partnerships alike, the world awaits China to exert strong climate leadership again among its emerging market allies.

For a copy of this Issue Brief, kindly download here.

About Climate Smart Ventures

Climate Smart Ventures (CSV) is a transition and transaction advisory firm with a track record for bringing together the Asia’s leading power asset owners, debt and equity providers, ESG investors and experts in accelerating South and Southeast Asia’s energy transition in a just, orderly, and competitive manner. To date, CSV has supported multilateral development banks, investors and corporates on developing robust and value creating transition strategies that have resulted in accelerated coal retirement and renewables replacement transactions, transition finance strategies, and just energy transition partnerships.

CSV is a core member of the Coal Asset Transition Accelerator or CATA – a first-of-its-kind platform focused on leveraging finance to accelerate the coal transition globally.

https://climatesmartventures.com, contact@climatesmartventures.com

Lily Gonzales is an associate at Climate Smart Ventures. She specializes in financial corporate strategy, M&A and industry development in emerging markets with a focus on renewable energy

Lawrence Ang is the co-founder and managing partner of Climate Smart Ventures, a transaction advisory firm delivering capital market-driven solutions that accelerate the energy transition in commercially viable ways in South and Southeast Asia.

About Green Finance & Development Center, FISF Fudan University

The Green Finance & Development Center (GFDC) at FISF, Fudan University is a leading independent think tank providing research, advisory services, and capacity building for financial institutions and regulators for green and sustainable finance in China and internationally. The GFDC works at the intersection of finance, policy and industry to accelerate the development and use of green and sustainable finance instruments to address the climate and biodiversity crisis, as well as contribute to better social development opportunities.

Christoph Nedopil is an Associate Professor of Practice in Economics at FISF Fudan University and the founding director of the Green Finance & Development Center. Before joining FISF, Christoph was the Founding Director of the IIGF Green BRI Center in Beijing at the Central University of Finance and Economics in Beijing, and worked with the World Bank for 10 years.

Sarah Tang is a non-resident research fellow at the Green Finance & Development Center. She previously served as Deputy Director for the Green BRI Center at International Institute of Green Finance in Beijing.