Scenarios for financial modeling of China-funded coal retirement in Asia

February 28, 2023

Christoph Nedopil, Director (GFDC)

Lawrence Ang, Managing Partner

Photo by Tom Fisk on Pexels

The role of scenarios for valuing early coal retirement opportunities

In this issue brief, we introduce three future scenarios to better evaluate the value of coal-fired power plants (CFPPs) for possible early retirement. We invite all interested friends and partners to share their thoughts & feedback on these scenarios via ziying.song@greenfdc.org.

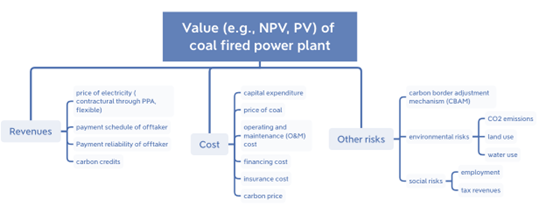

What is the value of a CFPP for retirement?

Discussions about the early retirement of CFPPs have flourished over the past year. Driven by a global understanding of the need to urgently reduce greenhouse gas emissions (GHG) to reduce the risk of catastrophic climate change, multiple ideas have emerged on how different tools of financing – from buy-outs to sustainability-linked debt, as well as ratepayer-backed securities to asset portfolio securitization – can be harnessed to ensure a just transition for affected stakeholders (several of those were highlighted in our previous issue brief).

A key element in evaluating financing needs and instruments for early retirement is the actual value of the CFPPs to be retired. This can be measured, among others, by the value that owners (the equity holders) had invested into the CFPPs to generate a financial return over the runtime of the power plant. The typical technical life or runtime of a power plant is expected to be 30 to 40 years and retiring a plant earlier would reduce the financial return of the equity holders and thus reduce the value of the asset. For typical investors, such a loss should be avoided else they would want to be compensated to recover this value.

One typical way to evaluate the value of an asset for investors, such as a CFPP, is to use the net present value (NPV) calculation. In an NPV calculation, future cash flows of the power plant are discounted to today’s value using a discount factor. This calculation allows one to understand the value of the power plant in today’s money. An important assumption is that having money today is worth more than having money in the future – as this money today can be invested and is real, rather than expected. In other words, money earned in 30 years from now is worth very little today.

It is important to mention, however, that evaluating future cash flows under this approach does not assure its certainty. They still depend on multiple factors that might influence the cost of the CFPP, such as fuel prices, financing costs, operation, and maintenance costs, as well as the revenues, such as the revenues per kWh or even the payment schedule and reliability of the off-taker. Some of those risks are regulated through the power purchasing agreement (PPA) between the CFPP owner and the off taker. Yet usually, this is valid only for a specified amount of time and specified risks.

Accordingly, future cash flows are subject to multiple complex and interrelated risks. Evaluating these risks should ideally be done through a systems-thinking approach based on more complex scenarios, rather than simply aiming to evaluate “high”, “medium” and “low” demand predictions. Such risks directly or indirectly impact revenues and costs and include, for example, payment risks, changes in financing costs, or broader risks through the introduction of carbon border adjustment mechanisms that make electricity sourced from CFPPs an economic burden for exports (e.g., into the European Union).

Three future scenarios impacting the value of CFPPs

To evaluate the value of CFPPs in Asia, we assume that the future is all but predictable with fast developments in technology, paired with political and economic uncertainties. With the goal to understand how different developments interact and impact CFPPs in Asia, we developed three scenarios for the year 2035 taking various developments into account. The scenarios are predominantly based on expert interviews and published research.

It is important to note that these scenarios serve only as an orientation of future energy development, but not as a prediction of the future. At the same time, the scenarios are generalizations that cannot detail developments for the diverse settings of CFPPs.

The three suggested scenarios are:

- Business as Usual (BAU)

- Choose Your Allies (Coal and RE balanced)

- Ministry of the Future (Coal out, RE in)

Scenario 1 – Business as Usual (BAU) Existing CFPPs are allowed and encouraged to continue operating under their current contracts. To keep relationships with CFPP owners strong and ensure energy security, further domestic coal mining is encouraged and PPAs that are at the end of their lifetime will be rolled over. Subsidies for fossil fuels remain in place to ensure low energy costs in times of continued risk of inflation. The government is supporting energy providers where possible to overcome non-revenue electricity provision (e.g., due to bad payment morale of off-takers) through direct transfers. Renewable energy (RE) is important for the future development of the energy system, but due to fears of intermittency and non-reliability, its roll-out is “gradual” to avoid disruptions. International and domestic private investors are invited to support the expansion of renewable energies in specific cases, while the government requires local content to be high to invite manufacturing into the country. This makes RE more expensive than if imports were easier. Internationally, the EU is implementing its carbon border adjustment mechanism (CBAM), and voluntary carbon markets (VCM) continue to be a promise, yet timelines for their implementations are being pushed back to at least 2035. |

Scenario 2 – Choose Your Allies (Coal and RE balanced) Military conflicts remain regionally confined, yet economic and political blocks are becoming more prevalent with the G7 and most of the EU leading a bloc of self-declared democracies, versus countries joining the other bloc through the Shanghai Cooperation Organization (SCO). Due to continued lack of fossil fuel supplies, the EU and G7 have strongly invested in RE development and are providing generous support for other allied countries’ green transition through technology and financial transfers. At the same time, the EU has installed a carbon border adjustment mechanism (CBAM) that charges 60-80% of the EU ETS price for imported emissions. The SCO countries support each other by buying and selling fossil fuels, which mutually benefits fossil fuel exporting countries to generate revenues and fossil-fuel buying countries through low-price energy. Global cooperation, particularly for high-tech products, is getting worse and trade barriers are becoming more commonplace. To avoid explicit or implicit sanctions from either bloc, most countries have chosen to collaborate with one side. While both major blocs consider green development the core of economic development as physical risks of climate change continue to materialize, economic competition between the blocs plus trade barriers requires them to rely on existing power sources as much as possible. While the political signaling continues to favor new energy development, entrenched interests and “economic realities” support local economic development (including mining) and require high local content for manufacturing. Thus, despite green virtue signaling, in practice, many SCO bloc countries support both energy sources to ensure energy security and mutually beneficial energy dependence. |

Scenario 3 – Ministry of the Future (Coal out, RE in) As the risk of physical damage from climate change is becoming too evident in too many places, a global agreement to accelerate the green energy transition has been reached in 2025. While each country still decides on its emission trajectory through Nationally Determined Contributions (NDCs), global funding and trade support for the energy transition have accelerated. In practice, this means that the EU has accelerated the establishment of the CBAM but provides 50% of its revenues for emerging markets’ energy transition, including the expansion of local manufacturing capacity. Global voluntary carbon markets have also been developed that calculate their carbon credits against the 2021 NDC scenario (that means that accelerated use of RE compared to the 2021 NDCs generates extra carbon credits). The VCM price is set at 50% of the EU ETM. Financing for non-RE has mostly dried up, with few investors reaping high benefits from still financing CFPPs. Insurance for CFPPs has become very expensive and difficult to obtain. Despite persisting trade barriers for several high-tech products between China and many Western countries, it was agreed that green technologies, particularly solar, wind, batteries, and hydrogen technologies are mostly exempt. Due to the higher localization of renewable electricity generation through decentralized energy networks, particularly in rural areas, co-ownership of power generation units has provided higher payment morale for electricity. |

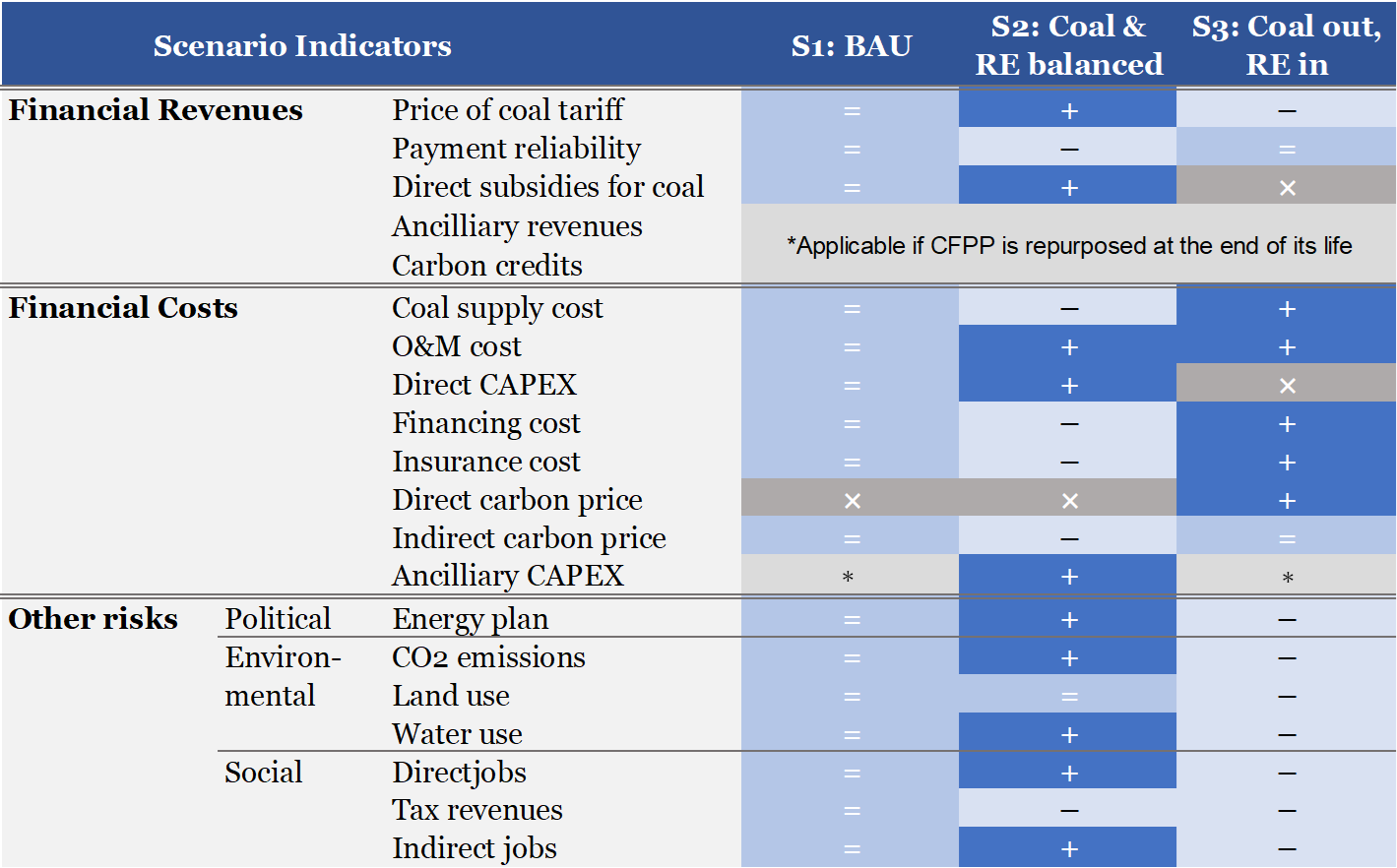

Each of these scenarios has specific implications for the cost structure of a CFPP – impacting financial revenues and financial cost. For example, a scenario 3 – Ministry of the Future – would reduce the price of a coal tariff and the coal supply cost. The following table shows how the different scenarios would impact the different aspects of the cost structure.

Table – Key CFPP indicators’ fluctuations based on scenario setting

|

Notes: · Legend: Equal sign (=) means status quo or 100% of current value, plus sign (+) means increased percentages of current value, negative sign (–) means decreased percentages of current value, ex (x) means not applicable, and asterisk (*) means applicable if conditions to repurpose the CFPP apply. · Payment reliability: collection rate of tariffs, i.e., to what percentage the tariffs are collected. · Direct subsidies for coal: subsidies for the provision of electricity, usually provided by the local government. · Ancillary revenues: revenues for ancillary or alternative services, e.g., when a CFPP is retired and used as energy storage, or when solar panels provide shade for higher-yield agriculture. · Carbon credits: revenues through carbon credits generated by CFPP early closure in domestic, or voluntary carbon markets. · Direct CAPEX: additional investments into assets and land (minus possible subsidies for assets), which depends on the availability of technology and sourcing, as well as price of inputs. · Financing cost: cost of financing, e.g., Weighted Average Cost of Capital (WACC), which depends on the willingness of financial institutions and banks to invest in assets and their expected return; also on political environment and contractual arrangement for energy. · Insurance cost: cost of insurance, which depends on the availability and willingness of insurers to insure political, business, and technological risks. · Direct carbon price: cost of carbon emissions, e.g., through a carbon tax or emission trading system. · Indirect carbon price: cost of carbon emissions charged by outsiders (e.g., EU CBAM), depending on export markets’ ability and willingness to introduce a carbon border adjustment mechanism. · Ancillary CAPEX: cost for investments into ancillary assets, such as transmission, energy storage, and fuel transport.

|

Each of the scenarios would impact the various factors driving revenues, cost, and other risks of CFPPs and thus the value of the CFPP. Similarly, the factors would impact any financing decisions for green energy investments. Ultimately, the scenarios can give a possible indication of how transactions gearing towards accelerating CFPP retirement can be properly structured with value optimization and risk management in mind.

In our next step, we will take these scenarios to evaluate current values of CFPPs to be able to compare them against alternative green investments.

For a copy of this Issue Brief, kindly download here.

About Climate Smart Ventures

Climate Smart Ventures (CSV) is a transition and transaction advisory firm with a track record for bringing together the Asia’s leading power asset owners, debt and equity providers, ESG investors and experts in accelerating South and Southeast Asia’s energy transition in a just, orderly, and competitive manner. To date, CSV has supported multilateral development banks, investors and corporates on developing robust and value creating transition strategies that have resulted in accelerated coal retirement and renewables replacement transactions, transition finance strategies, and just energy transition partnerships.

CSV is a core member of the Coal Asset Transition Accelerator or CATA – a first-of-its-kind platform focused on leveraging finance to accelerate the coal transition globally.

https://climatesmartventures.com, contact@climatesmartventures.com

Lawrence Ang is the co-founder and managing partner of Climate Smart Ventures, a transaction advisory firm delivering capital market-driven solutions that accelerate the energy transition in commercially viable ways in South and Southeast Asia.

About Green Finance & Development Center, FISF Fudan University

The Green Finance & Development Center (GFDC) at FISF, Fudan University is a leading independent think tank providing research, advisory services, and capacity building for financial institutions and regulators for green and sustainable finance in China and internationally. The GFDC works at the intersection of finance, policy and industry to accelerate the development and use of green and sustainable finance instruments to address the climate and biodiversity crisis, as well as contribute to better social development opportunities.

Christoph Nedopil is an Associate Professor of Practice in Economics at FISF Fudan University and the founding director of the Green Finance & Development Center. Before joining FISF, Christoph was the Founding Director of the IIGF Green BRI Center in Beijing at the Central University of Finance and Economics in Beijing, and worked with the World Bank for 10 years.